Are you curious about what NEA Credit Cards are? If yes, then be sure to read out this article as it's just for you

Jan 21, 2024 By Susan Kelly

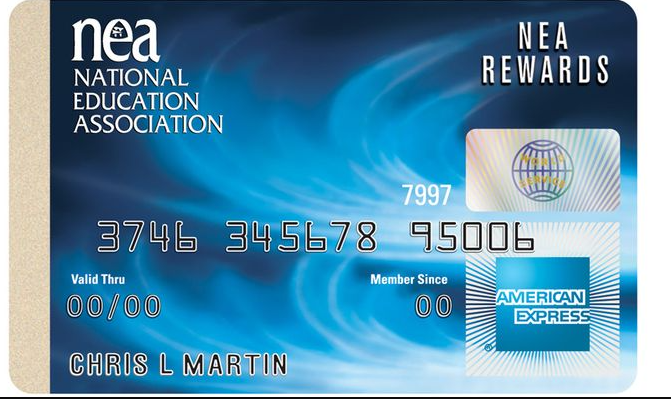

As a teacher or educator, you know how important it is to have access to the right resources and tools to help you do your job effectively. That's why the NEA Credit Cards are an excellent option to consider. Not only do they offer great benefits and rewards, but they are also specifically designed to meet the needs of educators.

In this article, we'll take a closer look at what the NEA Credit Cards are, what benefits they offer, and why they are an excellent choice for anyone in the field of education. So, if you're curious to learn more about how the NEA Credit Cards can benefit you as a teacher or educator, read on!

What Are NEA Credit Cards?

Attention all National Education Association members! Are you looking for a financial product that can help you save tons of money and earn rewards? Look no further than NEA Credit Cards! These cards are designed specifically for educators like you and offer a variety of benefits such as cashback, points, and discounts.

But that's not all - NEA Credit Cards also feature low APRs, no annual fees, and balance transfer options, which can help you save even more. Plus, by choosing an NEA credit card, you can support education-related causes and charities through your purchases.

What Are the Benefits of NEA Credit Cards?

NEA Credit Cards are a great way to enjoy a range of financial benefits while also supporting the education community. Here are some NEA Credit Cards benefits that you should know:

Save Money Everyday!

Firstly, NEA Credit Cards offer a range of rewards that can help you save money on your everyday spending. Depending on the specific card you choose, you may be eligible for cashback rewards, travel benefits, or other perks that can help you make the most of your money. Plus, many NEA Credit Cards come with no annual fee, making them an excellent choice for anyone who wants to save money on credit card fees.

Caters to all Educators and the Educational Community

Another benefit of NEA Credit Cards is that they are designed specifically for educators and the education community. This means that they come with features and benefits that are tailored to the needs of teachers and other education professionals. For example, some NEA Credit Cards offer rewards for purchases made at educational supply stores or for classroom supplies, which can be a great way to save money on teaching materials.

Top-Notch Security

In addition to these benefits, NEA Credit Cards also offer a range of extra security features that can help protect you against malicious identity theft. For example, many NEA Credit Cards come with zero liability protection, which means that you won't be held responsible for unauthorized charges made on your card. Plus, many NEA Credit Cards come with chip technology, which makes it harder for fraudsters to steal your credit card information.

A Chance to Support the Educational Community

Finally, NEA Credit Cards offer the opportunity to support the education community through your everyday spending. When you use an NEA Credit Card, a portion of your spending goes towards supporting the NEA Foundation, which provides grants and other resources to educators across the country. This means that you can make a positive impact on the education community simply by using your credit card for everyday purchases.

Top 5 Things to Know About NEA Credit Cards

NEA (National Education Association) Credit Cards are a smart choice for anyone who is a member of the NEA and looking for a credit card with great benefits and rewards. Here are the top 5 things that you need to know about NEA Credit Cards:

1. Membership is Required

Being a member of the NEA is a qualification to apply for an NEA credit card. This means that you will be joining a community that shares common goals and values. On top of it, the benefits are worth it.

2. Competitive Interest Rates

NEA Credit Cards offer interest rates that are highly competitive. You will enjoy lower interest rates than many other credit cards on the market. This means that you can quickly pay off your balance and save money on interest charges.

3. Rewards and Benefits

NEA Credit Cards offer an array of rewards and benefits, including cash back, points, and other perks. For example, you can earn cash back on purchases made at office supply stores and points that can be redeemed for additional rewards. Furthermore, many NEA Credit Cards come with benefits such as extended warranties, travel insurance, and fraud protection, which can provide added peace of mind.

4. Annual Fees

While some NEA Credit Cards have no annual fee, others may charge a yearly fee of up to $50. However, the rewards and benefits that come with an NEA credit card can offset this fee. If you are not a frequent credit card user, you may want to consider if an annual fee is worth it.

5. Limited Acceptance

NEA Credit Cards are not accepted everywhere, as they are issued by a smaller group of banks. However, this shouldn't discourage you from applying for an NEA credit card. As long as you keep in mind that NEA Credit Cards are designed for a specific niche of consumers, you can enjoy the benefits and rewards that come with it.

Wrapping it Up!

NEA Credit Cards are a wise choice for educators and other professionals who are members of the NEA. They offer competitive interest rates, rewards and benefits, and other perks that can help you save money and get more out of your purchases. Apply for an NEA credit card today and enjoy the benefits and rewards.