Navigating Retirement with a 401(k)

May 18, 2024 By Susan Kelly

A 401(k) retirement savings plan is a very important financial tool for numerous Americans, giving them a way to save money with tax benefits set aside for their future. Knowing the mechanism of how a 401(k) functions and its different parts becomes crucial in planning effectively for retirement.

Understanding 401(k) Basics

A 401(k) is a retirement savings plan offered by an employer. It permits employees to put some of their salary into this tax-deferred investment account through payroll deductions. These contributions are taken out from the employee's paycheck before any taxes are withheld, resulting in a reduction of their taxable income for that year.

Employers could also give matching contributions, which increase the total amount saved for retirement by an employee. Apart from tax benefits, a 401(k) usually provides the option for workers to adjust their contribution amounts according to their money matters and retirement objectives.

- Customizable contributions: Employees can adjust their contribution amounts to align with their financial goals and circumstances.

- Employer-sponsored: 401(k) plans are established and sponsored by employers, providing a convenient way for employees to save for retirement through automatic payroll deductions.

Exploring Contribution Limits and Tax Benefits

The amount you can contribute to a 401(k) every year is limited by the IRS. In 2024, individuals below the age of 50 can contribute up to $20,500 yearly while those who are 50 years or older have a catch-up contribution limit of an extra $6,500. The main advantage of having a 401(k) is that it provides tax benefits. Contributions are made before taxes, which decreases the individual's taxable income in that year.

Also, the 401(k) account lets investment earnings grow without any taxes until they are withdrawn at retirement time. Additionally, it is good for people to note that they can't carry over any unused contribution limits from one year to another. This highlights the need to make maximum contributions every year so as not to miss out on tax benefits completely.

- Annual contribution limits: Contributions to a 401(k) plan are subject to annual limits set by the IRS, which can vary based on age and other factors.

- Use-it-or-lose-it: Contribution limits do not roll over from year to year, so individuals should aim to maximize contributions annually to optimize tax benefits.

Employer Matching Contributions

Matching contributions from employers are given to encourage employees to join the 401(k) plan. The amount that an employer matches can differ, but it often falls between 3% and 6% of the employee's salary. For instance, if an employee contributes 3% of their salary to their 401(k) plan and the employer offers a match rate at this level too, then the total contribution becomes equivalent to 6% of what they earn every year.

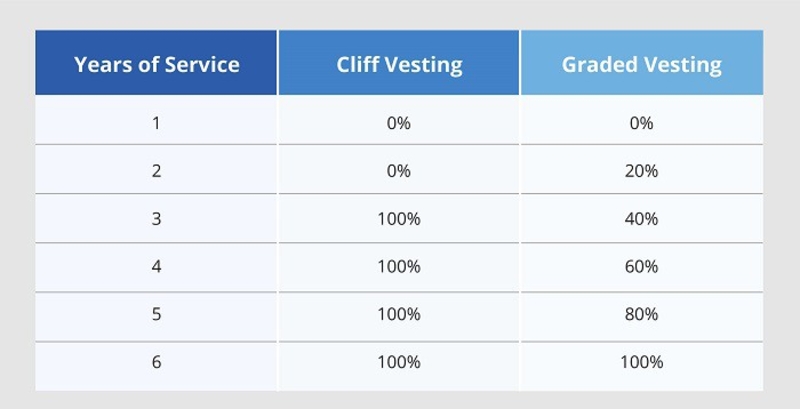

Employer matches are like getting free money because they increase the total amount of funds in an employee's retirement savings. This is a very useful benefit. In addition, you may find that employer matches are usually tied to a vesting schedule. This plan decides when workers get complete ownership of the money matched by their bosses.

- Vesting schedules: Employer matching contributions may be subject to vesting schedules, determining when employees gain full ownership of those funds.

- Free money: Employer matches provide additional retirement savings at no cost to the employee, enhancing the overall value of the 401(k) plan.

Understanding Investment Options

401(k) plans normally have a variety of investment selections, so the person taking part can decide where they want their contributions to be invested. Regular choices for investing could be mutual funds, index funds, exchange-traded funds (ETFs), and target-date funds. People participating in the 401(k) plan can distribute their contributions among these investment options according to what suits them best about risk level acceptance, aims for investing, and time remaining until retirement.

Moreover, people who take part in these plans must keep on checking and modifying their investment distributions. This is done to make sure that the way they are putting money into different options matches up with their financial aims and how much risk they can accept. Periodic balancing of investments might be useful for keeping a variety of assets in a portfolio and controlling risk efficiently.

- Portfolio diversification: Participants can diversify their investment portfolio by allocating contributions among different asset classes, reducing overall risk.

- Regular review: Periodic review and adjustment of investment allocations help ensure that the portfolio remains aligned with changing financial goals and risk tolerance.

Navigating Vesting Schedules

The contributions made by an employer into a 401(k) plan can sometimes be under the control of a vesting schedule. This schedule sets out when employees officially own these contributions. Vesting schedules are different for every employer but usually go from immediate vesting to a graded system where ownership is gained over some years of service. Employees must comprehend their employer's vesting schedule so they can make the most of the benefits offered through matching contributions from employers in this retirement savings account called 401(k) plan.

Additionally, people who are part of a retirement plan might find it helpful to know that employer contributions usually get forfeited if they quit the company before becoming fully vested. This knowledge about how vesting schedules work could affect choices related to switching jobs and planning for retirement.

- Forfeiture of unvested contributions: Employer contributions that are not fully vested may be forfeited if the employee leaves the company before reaching full vesting.

- Impact on retirement planning: Vesting schedules can impact retirement planning strategies, influencing decisions regarding job changes and the timing of retirement.

Planning for Retirement with a 401(k)

401(k) is an important tool to plan for retirement. It gives benefits like tax savings, matching from the employer, and different investment options. People who use it can build a strong financial future by knowing how 401(k)s work and using their advantages well. Regularly checking and changing the amount put into a 401(k), along with where money is invested, helps make sure that it still matches the long-term money goals of a person.